Transaction Fraud Detection in Python Projects

Transaction Fraud Detection in Python Projects

Transaction Fraud Detection in Python Projects

Abstract

Financial transaction fraud is a growing concern for banks, payment gateways, and e-commerce platforms, leading to substantial monetary losses and compromised user trust. The project Transaction Fraud Detection in Python Projects focuses on developing an intelligent system that detects fraudulent transactions using machine learning and data analysis techniques. Python is chosen as the development platform for its powerful libraries in data preprocessing, machine learning, and visualization, including Pandas, NumPy, Scikit-learn, TensorFlow, and Keras. The system collects transaction data, preprocesses it to handle missing values and categorical variables, and applies predictive models to identify suspicious activities. By providing real-time or near-real-time fraud detection, the system helps financial institutions reduce losses, enhance security, and protect customers.

Existing System

Existing fraud detection systems often rely on rule-based mechanisms, such as predefined thresholds, blacklists, or manual verification. While these methods can detect known fraud patterns, they struggle to identify novel, evolving, or sophisticated fraudulent activities. Traditional statistical models, such as logistic regression, can provide some predictive capability, but they often fail with large, imbalanced, and high-dimensional datasets. Moreover, these systems are limited in real-time adaptability, scalability, and precision, often generating false positives or missing subtle fraud patterns, which can result in financial losses and customer dissatisfaction.

Proposed System

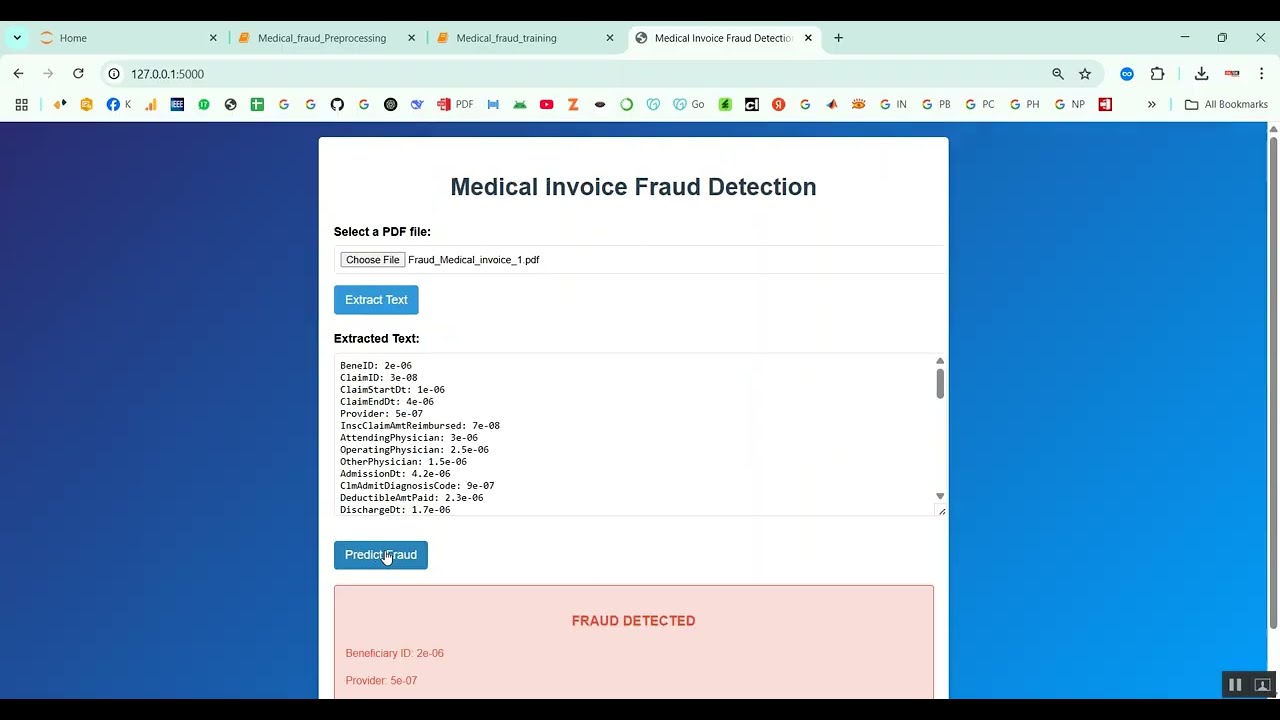

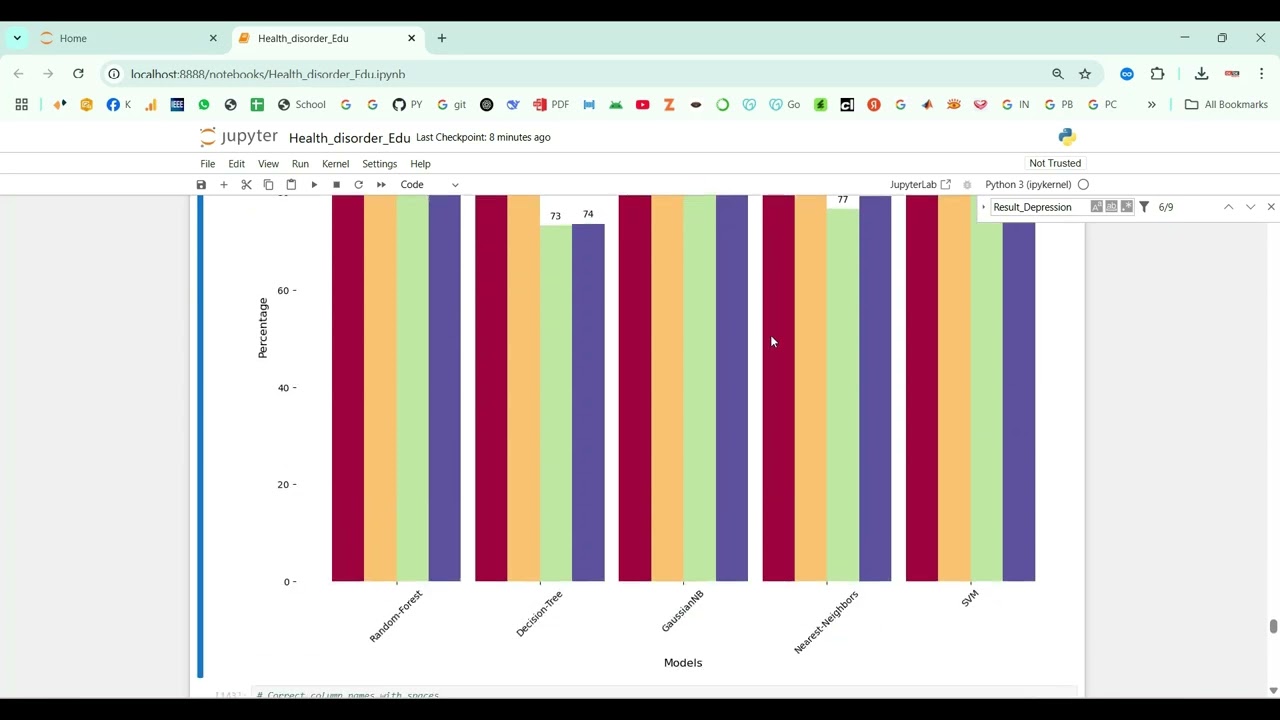

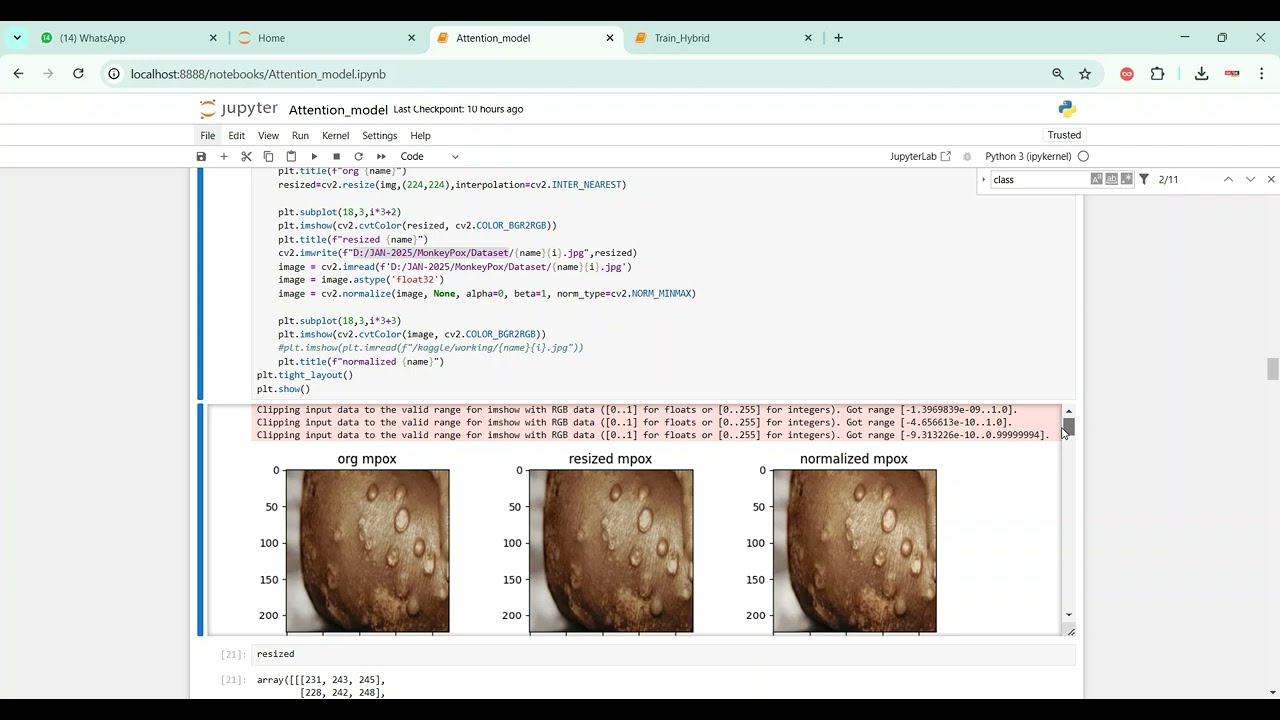

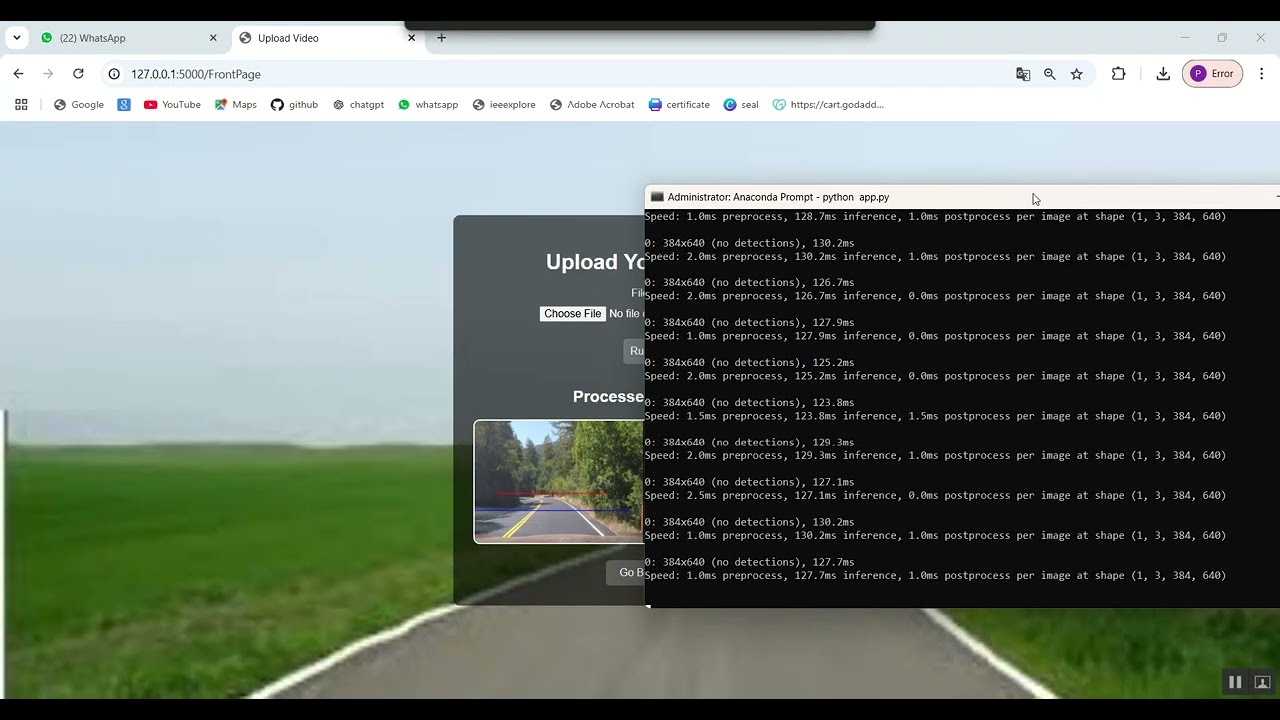

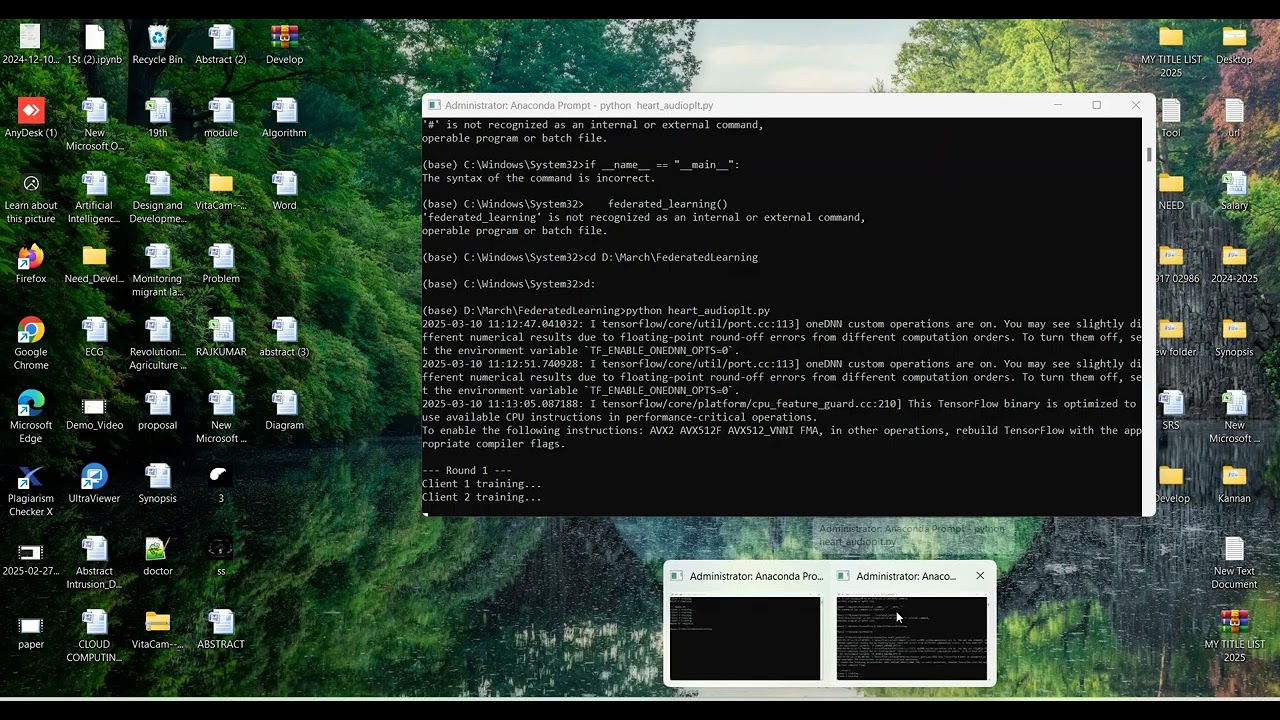

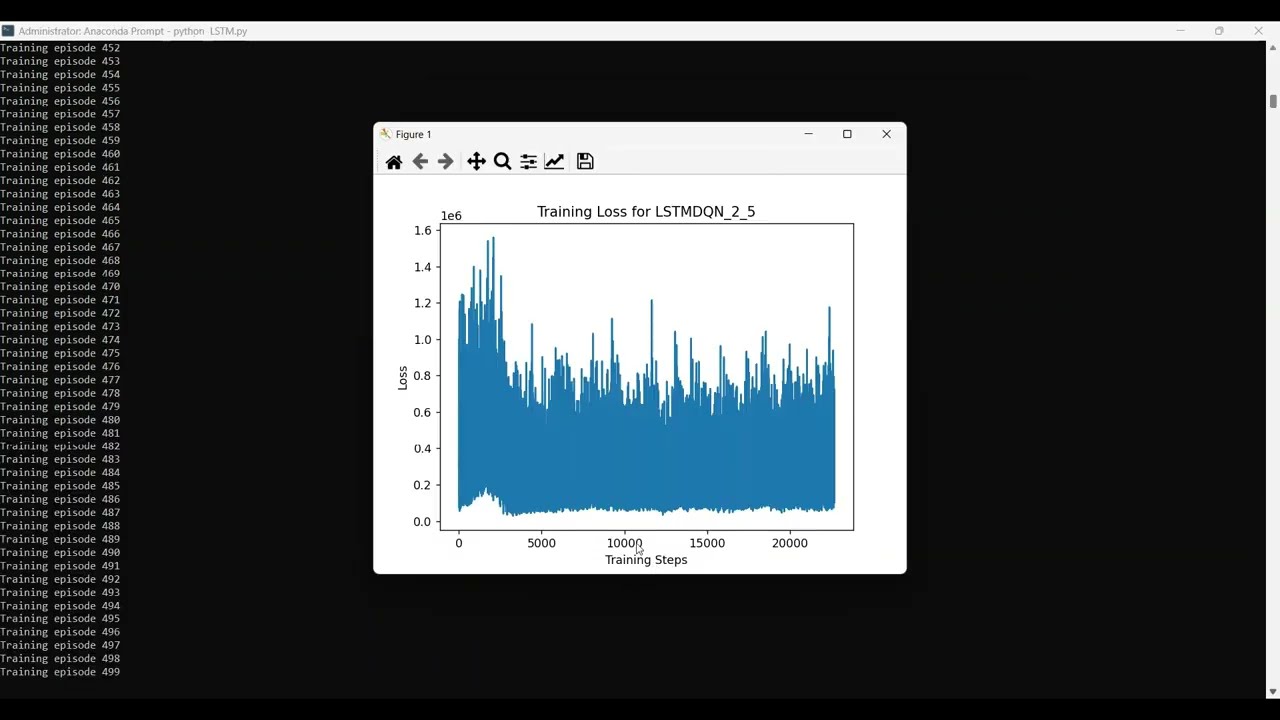

The proposed system introduces a Python-based framework for transaction fraud detection using advanced machine learning techniques. Transaction datasets are preprocessed by handling missing values, normalizing numerical features, and encoding categorical variables. Feature engineering techniques are applied to extract meaningful patterns from transaction amount, location, frequency, and user behavior. Machine learning models such as Random Forest, Gradient Boosting, Support Vector Machines (SVM), or deep learning architectures like LSTM and Autoencoders are trained to classify transactions as fraudulent or legitimate. Model performance is evaluated using metrics such as accuracy, precision, recall, F1-score, ROC-AUC, and confusion matrices. By integrating advanced modeling, feature engineering, and anomaly detection, the system provides a scalable, reliable, and automated solution for transaction fraud detection, helping financial institutions proactively secure their platforms and protect users.

What's Your Reaction

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0